north dakota sales tax refund

127 Bismarck North Dakota 58505-0599. Sales and Use Tax Revenue Law.

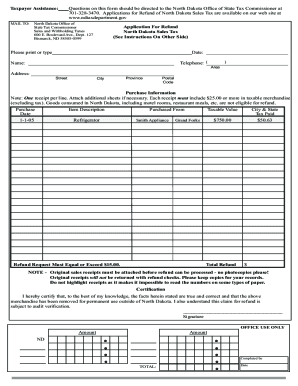

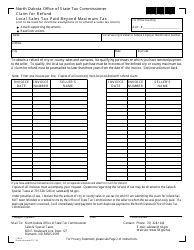

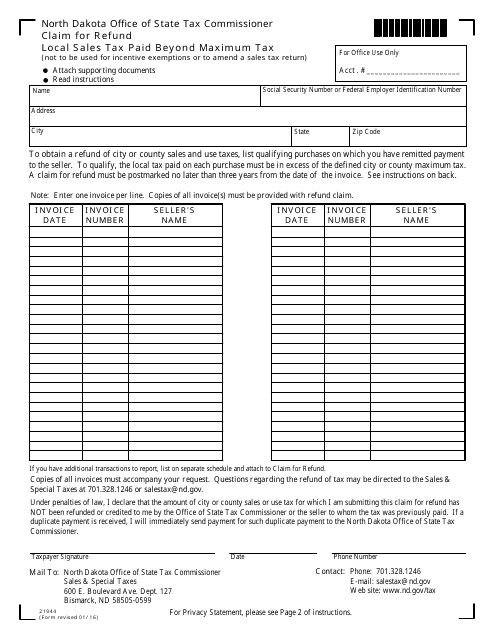

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

Quick guide on how to complete north dakota sales tax refund.

. Canadian residents may obtain a refund of North Dakota sales tax paid on qualifying purchases those purchased to be used exclusively outside the state. If a joint return provide your spouses name and social security number. If a joint return provide your spouses name and social security number.

Form 306 - Income Tax Withholding Return. How can we make this page better for you. North Dakota State Tax Refund Status Information.

Lastly here is the contact information for the state in case you end up needing help. Up to 10 cash back With TaxSlayer preparing and e-filing your North Dakota tax refund is quick and easy. North Dakota State Tax Refund Status Information.

Municipalities can also charge local sales tax. Amended Returns and Refund Claims. You can start checking on the status of your return within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return.

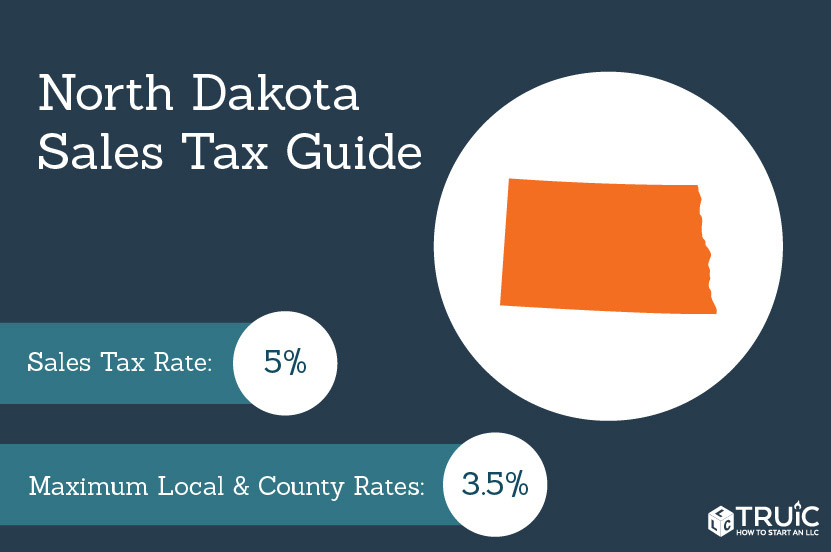

Start filing your tax return now. Currently combined sales tax rates in North Dakota range from 5 to 8. You will need to know.

Your social security number. Semi-Annual sales use and gross receipts tax return and payment are due for 2nd half of 2021. Ndgov Cory Fong Tax Commissioner NNoticeotice Sales Tax Request For Refund - Canadian Resident May 5 2009 In recent months the Tax Department has received a considerable number of sales tax refund.

The state sales tax rate for most purchases of tangible personal property in North Dakota is 5 and local governments can impose their own taxes as well. To qualify for a refund Canadian residents must be in North Dakota specifi cally to make a purchase and the goods purchased must be removed from North Dakota within 30 days of purchase for use permanently outside of North Dakota. Taxable purchases must be a least 25 per receipt and the refund request must be at least 15.

Loans are offered in amounts of 250 500 750 1250 or 3500. Generally speaking if you spent more than 2500 in sales tax to a single vendor in the past year your purchase qualifies for a refund. Your social security number.

Your social security number. Goods consumed in North Dakota including hotel rooms and dining are not eligible for a refund. North Dakota Offi ce of State Tax Commissioner PO Box 5527 7013281241 taxregistrationndgov Bismarck ND 58506-5527 TDD.

Form 301-EF - ACH Credit Authorization. Written Determinations Sales and Use Tax. This is an optional tax refund-related loan from MetaBank NA.

Use our detailed instructions to fill out and eSign your documents online. Refund statuses are updated daily. You can find this by signing in to TurboTax.

Your social security number. How to Get Help Filing a North Dakota Sales Tax Return. The statewide sales and use tax in North Dakota is 5.

Monthly sales use and gross receipts tax return and payment are due for December 2021. Forget about scanning and printing out forms. Refund Applied to Debt North Dakota participates in income tax refund offset which provides that an individual income tax must be applied to reduce a debt you may owe to a state or federal agency.

That means the effective rate across the state can vary substantially with the combined state and local rate in some places reaching 85. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 35. Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically.

Name phone number ZIP code and a detailed explanation of your question. 127 Bismarck ND 58505-0599. North Dakota Department of Taxation issues most refunds within 21 business days.

North Dakota sales tax payments. TAX DAY NOW MAY 17th - There are -360 days left until taxes are due. Choose direct deposit for the quickest turn-around time To track your refund go to North Dakotas Income Tax Refund Status page.

Tax Commissioner Reminds Taxpayers of Extension Deadline. The North Dakota Office of State Tax Commissioner is pleased to announce the launch of its new website wwwtaxndgov. The state will ask you to enter the exact amount of your expected refund in whole dollars.

Salestaxndgov North Dakota asks that you please include the following information in your email. Office of State Tax Commissioner. As a result the total sales tax can be as much as 85 in some parts of the state.

North Dakota also imposes sales tax at a rate of 7. Avalara can help your business. North Dakota Office of State Tax Commissioner Sales and Special Taxes 600 E.

Please note that if you file your North Dakota sales taxes by mail it may take significantly longer to process your. A claim for refund must be filed with the North Dakota Office of State Tax Commissioner Sales and Special Taxes 600 E. Refunds Things to Know.

You can check the status of your North Dakota income tax refund page. It is not your tax refund. If you need access to a database of all North Dakota local sales tax rates visit the sales tax data page.

North Dakota first adopted a general state sales tax in 1935 and since that time the rate has risen to 5. North Carolina Department of Revenue. Your filing status on the return single married filing.

With the launch of the new website also comes the release of the 2021 North Dakota income tax booklets and income tax forms and the 2022 income tax withholding tables. Direct Deposit If your bank refuses a direct deposit of a refund we will mail a paper check to you at the address listed on your return. SignNows web-based service is specially created to simplify the arrangement of workflow and optimize the whole process of competent document management.

Sales and Use Taxes. The claim for refund must include copies of all invoices to support the claim. Sign the form and submit it by mail to.

You will need to know. Quarterly sales use and gross receipts tax return and payment are due for 4th quarter of 2021. You may check the status of your refund on-line at North Dakota Tax Center.

Taxpayers may also file North Dakota sales tax returns by completing and mailing Form ST. PO Box 25000 Raleigh NC. Sales Use and Gross Receipts Tax Return to the following address.

Ad Have you expanded beyond marketplace selling. How to File Sales and Use Tax Resources. You can check the status of your North Dakota income tax refund page.

Furthermore refunds are available only on taxable purchases of 2500 or more. Your filing status on the return single married filing. Approval and loan amount based on expected refund amount eligibility criteria and underwriting.

Ndtax Department Ndtaxdepartment Twitter

North Dakota Tax Refund Fill Out And Sign Printable Pdf Template Signnow

South Dakota 529 Plan And College Savings Options Collegeaccess 529

Where S My Refund Of North Dakota Taxes

Form Sfn 21854 Certificate Of Purchase Exempt Sales To A Person From Montana

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

North Dakota Tax Refund Fill Online Printable Fillable Blank Pdffiller

Contractors Be Sure To Get Your Dor Supplies Before You Begin Your Project South Dakota Department Of Revenue

How To File And Pay Sales Tax In North Dakota Taxvalet

How To File And Pay Sales Tax In North Dakota Taxvalet

North Dakota Sales Tax Small Business Guide Truic

North Dakota Income Tax Calculator Nd Income Tax Rate Community Tax

File North Dakota Taxes Get A Fast Tax Refund E File Com

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

Where S My North Dakota State Tax Refund Taxact Blog

Income Tax Update Special Session 2021

North Dakota Tax Forms And Instructions For 2021 Form Nd 1

Form 40 Qr 28755 Download Fillable Pdf Or Fill Online Application For Quick Refund Of Overpayment Of Estimated Income Tax For Corporations North Dakota Templateroller